A) Systematic risk.

B) Unsystematic risk.

C) Diversifiable risk.

D) Global risk.

E) Foreign exchange risk.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the best definition of beta coefficient?

A) Amount of systematic risk present in a particular risky asset relative to an average risky asset.

B) Group of assets such as stocks and bonds held by an investor.

C) The difference between the return on a risky investment and a risk-free investment

D) Return on a risky asset expected in the future.

E) Equation of the SML showing the relationship between expected return and beta.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the best definition of market risk premium?

A) Percentage of a portfolio's total value in a particular asset.

B) Group of assets such as stocks and bonds held by an investor.

C) The difference between the return on a risky investment and a risk-free investment

D) Return on a risky asset expected in the future.

E) Equation of the SML showing the relationship between expected return and beta.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You want your portfolio beta to be 1.10. Currently, your portfolio consists of $3,000 invested in stock A with a beta of 1.65 and $2,000 in stock B with a beta of .72. You have another $5,000 to invest And want to divide it between an asset with a beta of 1.48 and a risk-free asset. How much should You invest in the risk-free asset?

A) $0

B) $775

C) $1,885

D) $3,115

E) $5,000

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

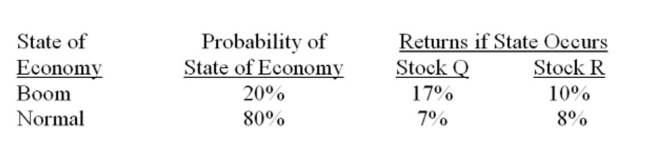

What is the standard deviation of a portfolio that is invested 68% in stock Q and 32% in stock R?

A) 2.7%

B) 3.0%

C) 3.2%

D) 4.1%

E) 4.3%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The risk premium increases as the non-diversifiable risk increases.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You own two risky assets, both of which plot on the security market line. Asset A has an expected return of 12% and a beta of 0.8. Asset B has an expected return of 18% and a beta of 1.4. If your Portfolio beta is the same as the market portfolio, what proportion of your funds are invested in Asset A?

A) 0.33

B) 0.50

C) 0.67

D) 1.33

E) 1.67

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Using the Capital Asset Pricing Model (CAPM), a decrease in the risk premium will increase the expected rate of return on an individual security. Assume that the security's beta, the risk-free rate of return, and the market rate of return are all positive.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Assume you are looking at a graph depicting the security market line. A stock which is undervalued will plot on that graph:

A) To the right of the overall market.

B) To the left of the overall market.

C) Above the security market line.

D) On the security market line.

E) Below the security market line.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A portfolio is comprised of five risky stocks. The standard deviations of these stocks are 5.6%, 12.8%, 2.3%, 8.9%, and 10.2%. The standard deviation of the portfolio:

A) Is equal to the arithmetic average of the individual standard deviations.

B) Must be greater than 2.3%.

C) Must equal that of the market.

D) Is equal to the weighted average of the individual standard deviations.

E) Cannot be determined from the information provided.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The market risk premium of an individual security is dependent upon the security's systematic risk.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

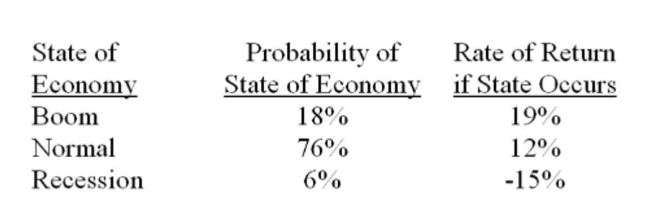

What is the standard deviation of the returns on a stock given the following information?

A) 7.24%

B) 7.64%

C) 9.26%

D) 9.75%

E) 27.64%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

No matter how much total risk an asset has, only the unsystematic portion is relevant in determining the expected return on that asset.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investment firm is considering a portfolio with equal weighting in a cyclical stock and a countercyclical stock. It is expected that there will be three economic states; Good, Average and Bad, each with equal probabilities of occurrence. The cyclical stock is expected to have returns of 12%, 5% and 1% in Good, Average and Bad economies respectively. The countercyclical stock is Expected to have returns of -8%, 2% and 14% in Good, Average and Bad economies respectively. Given this information, calculate portfolio variance.

A) .00094

B) .00084

C) .00074

D) .00064

E) .00054

G) A) and C)

Correct Answer

verified

E

Correct Answer

verified

Multiple Choice

Which one of the following would tend to indicate that a portfolio is being effectively diversified?

A) An increase in the portfolio beta.

B) A decrease in the portfolio beta.

C) An increase in the portfolio rate of return.

D) An increase in the portfolio standard deviation.

E) A decrease in the portfolio standard deviation.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

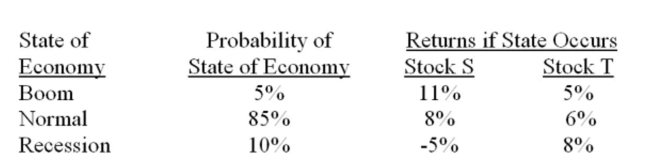

What is the standard deviation of a portfolio which is comprised of $9,000 invested in stock S and $6,000 in stock T?

A) 2.1%

B) 3.6%

C) 4.0%

D) 4.4%

E) 6.3%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

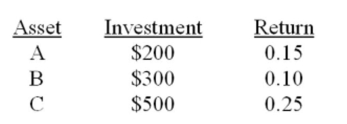

What is the expected return for the following portfolio?

A) 10%

B) 11.5%

C) 12.25%

D) 15.5%

E) 18.5%

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The expected return on an individual asset depends only on that asset's ____ risk.

A) Total.

B) Incremental.

C) Systematic.

D) Unsystematic.

E) Portfolio.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Asset A, which has an expected return of 12% and a beta of 0.8, plots on the security market line. Which of the following is false about Asset B, another risky asset with a beta of 1.4?

A) If the market is in equilibrium, Asset B also plots on the SML.

B) If Asset B plots on the SML, then Asset B and Asset A have the same reward to risk ratio.

C) Asset B has more systematic risk than both Asset A and the market portfolio.

D) If Asset B plots on the SML with an expected return = 18%, then the risk-free rate must be 4%.

E) If Asset B plots on the SML with an expected return = 18%, the expected return on the market must be 15%.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Systematic risk is considered important because ________________________.

A) It is needed in order to measure the total risk of an asset.

B) The risk premium depends only on this type of risk.

C) The market does not provide a reward for this type of risk.

D) The risk premium depends on both systematic and unsystematic risk.

E) Investors are willing to pay more for stocks with high systematic risk components.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 417

Related Exams