B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

We can be sure that, in and of itself, a stock dividend will not affect which of the following financial aspects of the firm? (Assume the stock has a par value.)

A) Market value per share.

B) Book value per share.

C) Common stock account.

D) Paid-in capital account.

E) Total assets.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When a firm pays off a loan using cash, the source of funds is the decrease in the asset account, cash, while the use of funds involves a decrease in a liability account, debt.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cannon Company has enjoyed a rapid increase in sales in recent years, following a decision to sell on credit.However, the firm has noticed a recent increase in its collection period.Last year, total sales were $1 million, and $250,000 of these sales were on credit.During the year, the accounts receivable account averaged $41,664.It is expected that sales will increase in the forthcoming year by 50 percent, and, while credit sales should continue to be the same proportion of total sales, it is expected that the days sales outstanding will also increase by 50 percent.If the resulting increase in accounts receivable must be financed by external funds, how much external funding will Cannon need?

A) $41,664

B) $52,086

C) $47,359

D) $106,471

E) $93,750

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The income statement measures the flow of funds into (i.e.revenue) and out of (i.e.expenses) the firm over a certain time period.It is always based on accounting data.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alumbat Corporation has $800,000 of debt outstanding, and it pays an interest rate of 10 percent annually on its bank loan.Alumbat's annual sales are $3,200,000; its average tax rate is 40 percent; and its net profit margin on sales is 6 percent.If the company does not maintain a TIE ratio of at least 4 times, its bank will refuse to renew its loan, and bankruptcy will result.What is Alumbat's current TIE ratio?

A) 2.4

B) 3.4

C) 3.6

D) 4.0

E) 5.0

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

In order to accurately estimate cash flow from operations, depreciation must be added back to net income.The reason for this is that even though depreciation is deducted from revenue it is really a non-cash charge.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As a short-term creditor concerned with a company's ability to meet its financial obligation to you, which one of the following combinations of ratios would you most likely prefer? Current Debt Ratio TIE ratio

A) 0.5 0.5 0.33

B) 1.0 1.0 0.50

C) 1.5 1.5 0.50

D) 2.0 1.0 0.67

E) 2.5 0.5 0.71

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) If two firms pay the same interest rate on their debt and have the same rate of return on assets, and if that ROA is positive, the firm with the higher debt ratio will also have a higher rate of return on common equity.

B) One of the problems of ratio analysis is that the relationships are subject to manipulation.For example, we know that if we use some of our cash to pay off some of our current liabilities, the current ratio will always increase, especially if the current ratio is weak initially.

C) Generally, firms with high profit margins have high asset turnover ratios, and firms with low profit margins have low turnover ratios; this result is exactly as predicted by the Du Pont equation.

D) Firms A and B have identical earnings and identical dividend payout ratios.If Firm A's growth rate is higher than that of Firm B, Firm A's P/E ratio must be greater than Firm B's P/E ratio.

E) None of the above statements is correct.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A(n) ____ is a statement summarizing the firm's revenue and expenses over an accounting period.

A) income statement

B) balance sheet

C) statement of cash flows

D) statement of retained earnings

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Velcraft Company has 20,000,000 shares of common stock authorized, but to date, has only 12,000,000 shares outstanding, each with a $1.00 par value.The company has $24,000,000 in additional paid-in capital and retained earnings are $96,000,000.What is Velcraft's current book value per share?

A) $1.00

B) $3.00

C) $11.00

D) $6.60

E) $9.00

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) In a reverse split, a company reduces the number of shares outstanding in order to stabilize and provide a floor for a rapidly declining stock price.

B) In theory, dividends are determined as a residual item.Therefore, in order to conserve earnings for better future earnings opportunities, the poorer the firm's investment opportunities, the lower its dividend payments should be.

C) The farther to the right the IOS is the higher a firm's dividend payout ratio, other things held constant.

D) Even if a stock split has no information content, and even if the dividend per share adjusted for the split does not increase, there can still be a real benefit (i.e., a higher value for shareholders) from such a split, but any such benefit is probably small.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Changes in balance sheet accounts are necessary for

A) A typical ratio analysis.

B) Pro forma balance sheet construction.

C) Statement of cash flows construction.

D) Profit and loss analysis.

E) Pro forma income statement construction.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm has total assets of $1,000,000 and a debt ratio of 30 percent.Currently, it has sales of $2,500,000, total fixed costs of $1,000,000, and EBIT of $50,000.If the firm's before-tax cost of debt is 10 percent and the firm's tax rate is 40 percent, what is the firm's ROE?

A) 1.7%

B) 2.5%

C) 6.0%

D) 8.3%

E) 9.8%

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Since ROA measures the firm's effective utilization of assets (without considering how these assets are financed), two firms with the same EBIT must have the same ROA.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Recently the M&M Company has been having problems.As a result, its financial situation has deteriorated.M&M approached the First National Bank for a badly needed loan, but the loan officer insisted that the current ratio (now 0.5) be improved to at least 0.8 before the bank would even consider granting the credit.Which of the following actions would do the most to improve the ratio in the short run?

A) Using some cash to pay off some current liabilities.

B) Collecting some of the current accounts receivable.

C) Paying off some long-term debt.

D) Selling some of the existing inventory at cost.

E) Purchasing additional inventory on credit (accounts payable) .

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

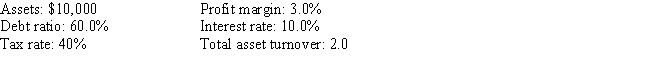

Lombardi Trucking Company has the following data:  What is Lombardi's TIE ratio?

What is Lombardi's TIE ratio?

A) 0.95

B) 1.75

C) 2.10

D) 2.67

E) 3.45

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are given the following information: Stockholders' equity = $1,250; price/earnings ratio = 5; shares outstanding = 25; market/book ratio = 1.5.Calculate the market price of a share of the company's stock.

A) $33.33

B) $75.00

C) $10.00

D) $166.67

E) $133.32

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The current ratio and inventory turnover ratio measure the liquidity of a firm.The current ratio measures the relation of a firm's current assets to its current liabilities and the inventory turnover ratio measures how rapidly a firm turns its inventory back into a "quick" asset or cash.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ____ provides a good indication of the firm's ability to meet its current obligations.

A) debt ratio

B) profit margin

C) days sales outstanding

D) quick ratio

E) return on equity

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 123

Related Exams